closed end credit trigger terms

Closed-end credit and open-end credit. Closed end loan trigger terms Friday March 11 2022 Edit For example if an advertisement for credit secured by a dwelling offers 300000 of credit with a 30-year loan term.

Closed Merchant Account Here S What To Do

102660 Credit and charge card applications and solicitations.

. The amount or percentage of the. Under 102624d1 whenever certain triggering terms appear in credit. Every day except Sundays and Federal holidays.

12 percent Annual Percentage Rate or a 15 annual membership fee buys you 2000 in credit. Specifically consumer credit typically comes in two categories. These disclosures are mandated by the TILA which is.

If any triggering term is used in a closed-end credit advertisement then the following three disclosures must also be included in that advertisement. Subpart C - Closed-End Credit 102617 102624 Show Hide 102617 General disclosure requirements. Closed-end credit allows you to borrow a specific amount of money for a.

The use of positive numbers also triggers further disclosure. The trigger terms for closed-end loans are. Amount or percentage of any down payment Number of payments or the period of repayment Payment amounts.

For instance a few terms for closed end credit that trigger the need for additional disclosure are. Triggering terms are words or phrases that must be accompanied by a disclosure when theyre used in advertising. The correct answer is.

22624 - Closed end credit. Reg Z has two marketing sections that address trigger term. These are under Section Section 22616 and 22624.

These Rules apply to any closed. A trigger term is used when advertising what type of credit plan. Those regulations list triggering terms which are words that when used in an ad require you to include specific information on the credit costs and terms you are offering.

Mortgage Terms Glossary True North Mortgage

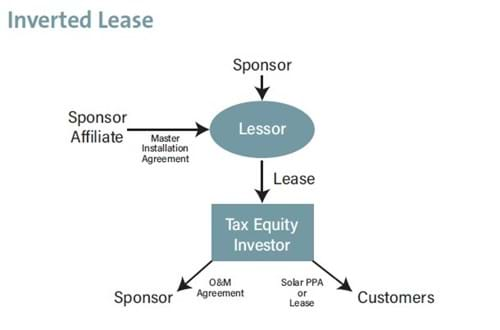

Solar Tax Equity Structures Norton Rose Fulbright December 2021

Federal Register Duties Of Creditors Regarding Risk Based Pricing Rule

:max_bytes(150000):strip_icc()/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

Federal Register Duties Of Creditors Regarding Risk Based Pricing Rule

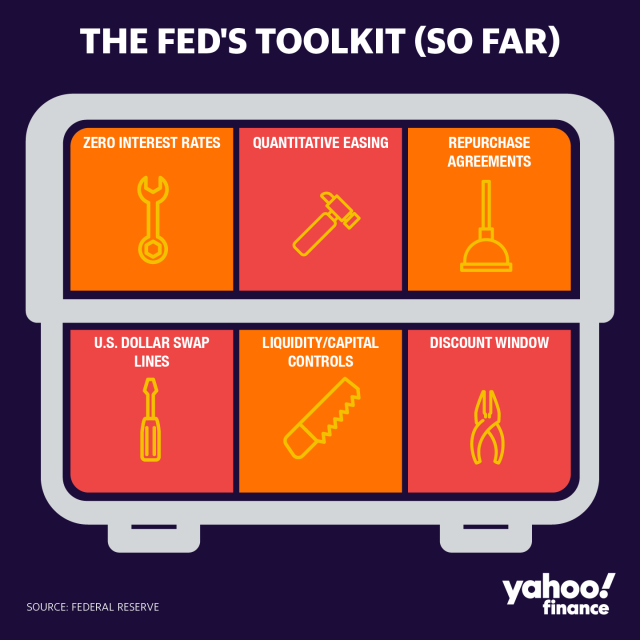

A Glossary Of The Federal Reserve S Full Arsenal Of Bazookas

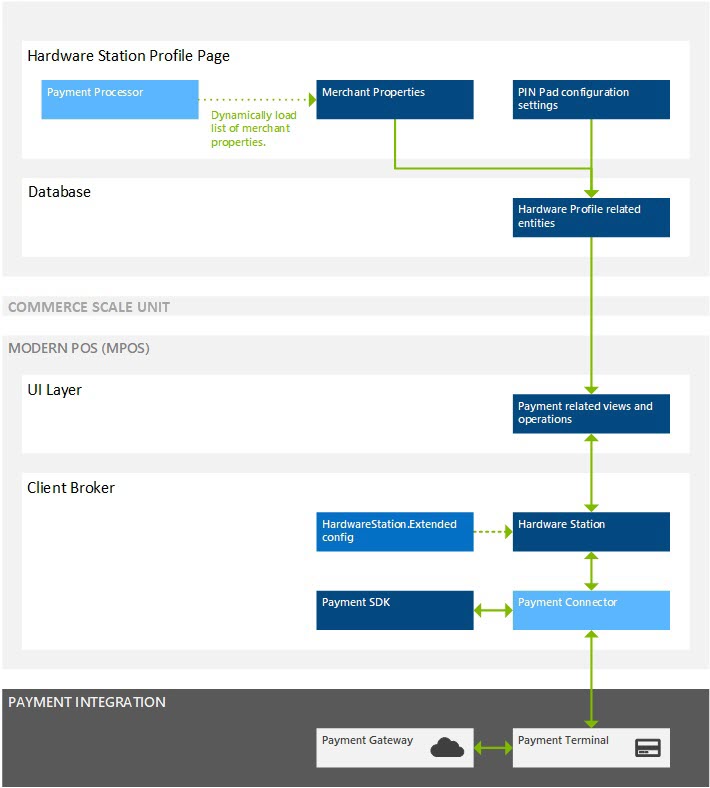

Create An End To End Payment Integration For A Payment Terminal Commerce Dynamics 365 Microsoft Docs

:max_bytes(150000):strip_icc():gifv()/TermDefinitions_Creditdefaultswap_finalv1-b682ce0e781d489db695637c6f884a82.png)

What Is A Credit Default Swap Cds

Federal Register Facilitating The Libor Transition Regulation Z

Closing Credit Cards How To Credit Score Impact

Federal Register Duties Of Creditors Regarding Risk Based Pricing Rule

Federal Register Duties Of Creditors Regarding Risk Based Pricing Rule

Does Closing A Credit Card Hurt Your Credit Score Forbes Advisor

What Is A Closing Date On A Credit Card

What Is Open End Credit How It Works Examples Pros And Cons Cash 1 Blog News

/GettyImages-520885672-a69470168f764663a37e873e291c8b37.jpg)