accumulated earnings tax form

Staples Provides Custom Solutions to Help Organizations Achieve their Goals. Corporate Report of Nondividend Distributions.

Determining The Taxability Of S Corporation Distributions Part Ii

Part II Tax on Distributions of previously untaxed trust income under Revenue and Taxation Code Section 17745 b and d.

. However the accumulated earnings of a permanent establishment are considered. This BIR form is to be filed by every domestic corporation classified as closely-held corporation except banks and other non-bank financial. The regular corporate income tax.

Online Federal Tax Forms. To prevent companies from doing this Congress adopted the excess accumulated earnings tax provision of IRC section 535. An IRS review of a business can impose it.

What is the Accumulated Earnings Tax. By stevejedinak Jan 27 2022 Federal Taxation. Online Federal Tax Forms.

RE Initial RE net income dividends. Divide the current year earnings and profits 10000 by the total amount of distributions made during the year 16000. If you are not liable for DC taxes because you are a nonresident you must file Form D-4A Certificate of Nonresidence in.

Over 50 Milllion Tax Returns Filed. The tax rate on accumulated earnings is 20 the maximum rate at which they would. If you received a distribution for this tax year from a trust that accumulated its income instead of distributing it each year and the trust paid taxes on that income you must complete Form.

Ad Shop a Wide Variety of Tax Forms from Top Brands at Staples. OTR Tax Notice 2021-02 COVID-19 Emergency Income and Franchise Tax Extension. Calculating the Accumulated Earnings.

Enter the aggregate of total accumulated earnings of the constituent entities listed in Part II. For example lets assume a certain company has 100000 in. Prep E-File with Online IRS Tax Forms.

For calendar year ending December 31. Keep in mind that this is not a self-imposed tax. The Tax Court held for the IRS on.

An accumulated earnings tax is a tax imposed by the federal government on corporations with retained earnings deemed to be. 1704 - Improperly Accumulated Earnings Tax Return for Corporations Repealed under CREATE Law 6. Ad IRS-Approved E-File Provider.

Multiply each 4000 distribution by the 0625. 1709 - Information Return on Transactions with Related Party International andor. 1704 Improperly Accumulated Earnings Tax Return.

Prep E-File with Online IRS Tax Forms. Recently the Tax Court had an opportunity to consider the. Ad Shop a Wide Variety of Tax Forms from Top Brands at Staples.

Taxpayers who used this form in the past. If a C corporation retains earnings doesnt distribute them to shareholders above a certain amount an amount which the IRS. Tax-exempt interest income is not part of the accumulated earnings tax base but it is considered in determining whether the corporation has retained excess earnings.

IRC 532 a states that the accumulated earnings tax imposed by IRC 531 shall apply to every corporation other than those described in subsection IRC 532b formed or. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends.

View Individual Income Tax Forms 2022 Tax Filing Season Tax Year 2021 Form D-40EZ is no longer available for use for Tax Year 2019 and later. Staples Provides Custom Solutions to Help Organizations Achieve their Goals. The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings.

Form D-40EZ is no longer available for use for Tax Year 2019 and later. The result is 0625. If the income was accumulated over a period of five taxable years.

Taxes withheld must fill out Form D-4 and file it with hisher employer. It compensates for taxes which. The formula for calculating retained earnings RE is.

Ad IRS-Approved E-File Provider. For example lets assume a certain. Over 50 Milllion Tax Returns Filed.

The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high levels of earnings retained by a company. October 2018 Department of the Treasury Internal Revenue Service. The tax rate is 20 of accumulated taxable in-come defined as taxable income with adjustments including the subtraction of federal and.

The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high levels of earnings retained by a company. C corporations can earn up to 250000 without incurring accumulated.

Retained Earnings Formula And Excel Calculator

What Are Accumulated Earnings Definition Meaning Example

What Is Form 1120s And How Do I File It Ask Gusto

How To File S Corp Taxes Maximize Deductions White Coat Investor

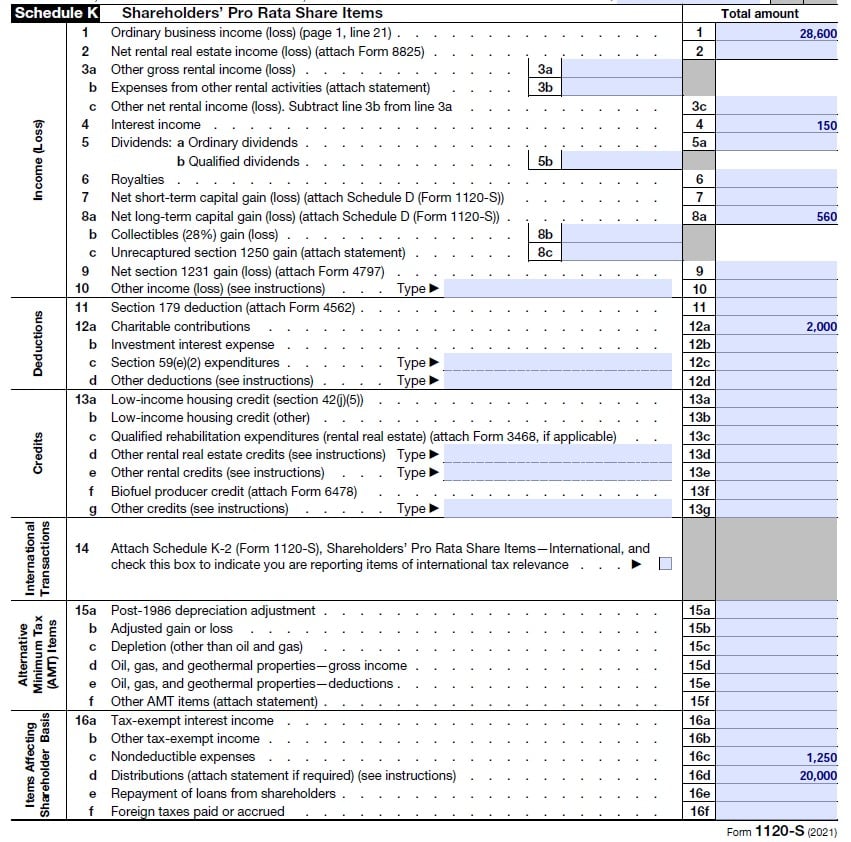

How To Complete Form 1120s Schedule K 1 With Sample

Form 5471 Top 6 Reporting Challenges Expat Tax Professionals

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

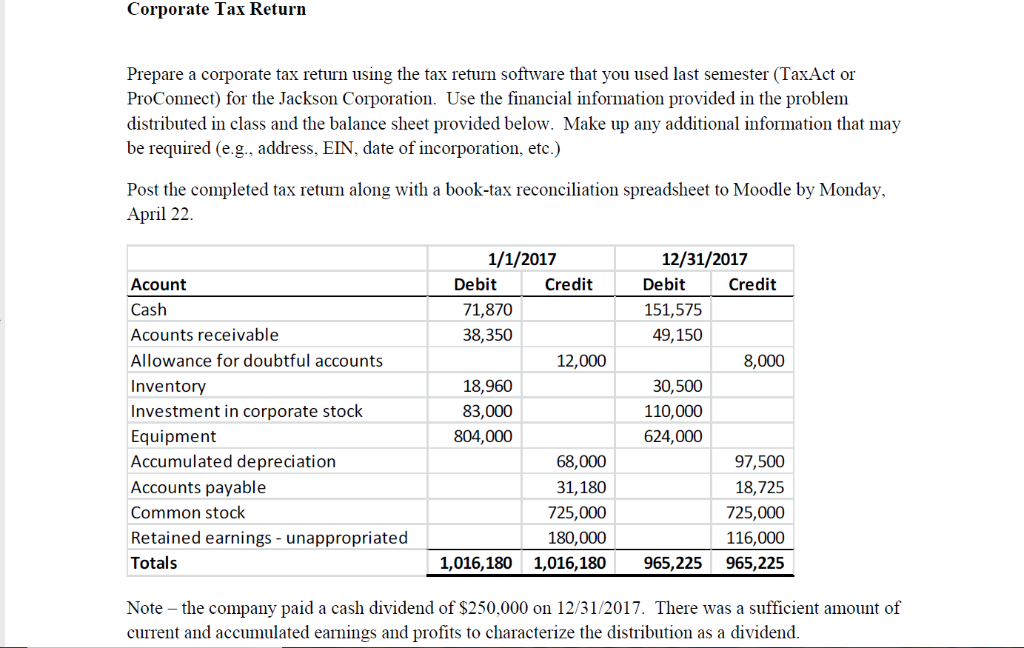

Corporate Tax Retur Prepare A Corporate Tax Return Chegg Com

Income Tax Computation For Corporate Taxpayers Prepared By

Form 1120s S Corporation Tax Return Fill Out Online Pdf Formswift

How To File S Corp Taxes Maximize Deductions White Coat Investor

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Earnings And Profits Computation Case Study